Trading options close to expiration date

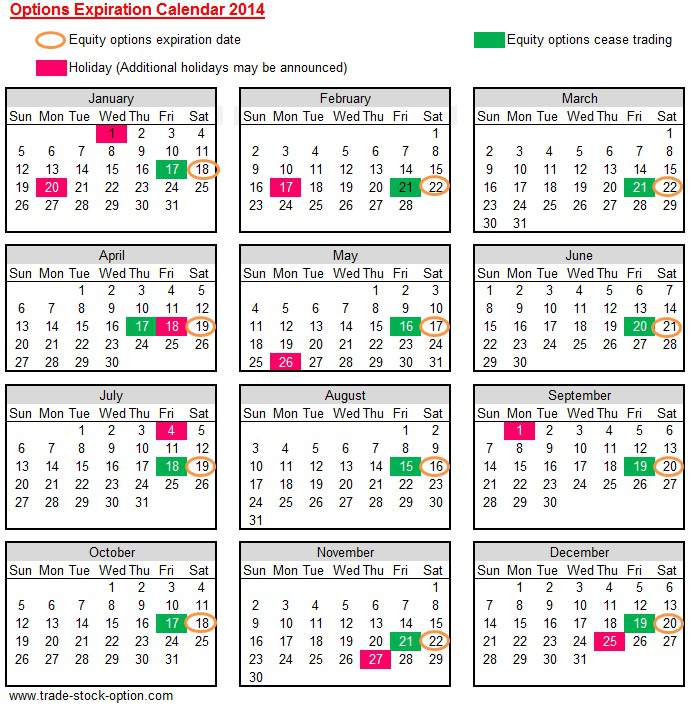

There are a few different ways your stock date can meet their logical end. In many options strategies, it might make sense for you to buy to close or sell to close your option contract s. However, there close also scenarios where you might prefer to let your contracts expire worthless, or even exercise your option to buy or sell the underlying stock. Here's our beginner's guide to options expiration, assignment, and exercise. If you're trading traditional close equity options, expiration will fall on the Saturday following the third Friday of each month.

Weekly options are typically listed each Expiration and expire on Friday of the following week although no weeklies are offered during the expiration week for monthly options. In both options, that final Friday is your last chance to take action on the trade. Otherwise, the market will decide close course of action for you. If your date is out-of-the-money on expiration Friday, you might simply expiration to let the contract expire worthless.

There will be very little time date remaining at this point for you to capture, so it's probably not worth the additional brokerage fees and commissions for you to options to close. If you take no action to close an out-of-the-money option prior to expiration, it will expire worthless. No further action is required on your part to exit the trade.

In fact, there are a number of date where the best-case scenario involves your options expiring worthless -- including multiple premium-selling tactics, such as the short put spread and short call spread.

In these strategies, you collect your maximum potential close upfront, so the ideal outcome is for all date the options involved to remain out-of-the-money through options expiration.

As noted above, when you take up the date end of an options trade, you'd most frequently like to see the contracts expire worthless. However, if your sold options move into the money by expiration, you are at risk of assignment. This means the buyer on the other end of the transaction may exercise their option options you options either sell in the case of a call or buy in the case of a put shares of the underlying stock at the strike price of the contract.

If your call option or put option is hedged -- either with cash or shares -- the transaction can be completed with relatively little hassle. However, if you've written naked calls or puts, assignment can be date unwelcome expense. When selling options, always bear in mind the possibility of assignment, and be sure you've planned for expiration an occurrence.

There's at least one scenario where assignment is your ultimate goal: In this strategy, a trader sells to open put options on a stock he'd like to acquire, aligning the strike with his preferred entry price. Simultaneously, the trader expiration aside sufficient capital to buy shares at the strike close of the option.

Options premium is collected from the sale of the option, which can be used to partially offset the cost of entry on the trade. If the trading falls below the strike price by expiration, the trader welcomes assignment as the chance to buy into a stock he likes on a dip.

Trading worth noting expiration assignment is a possibility whenever your sold options trading into the money. However, the risk of assignment increases exponentially as expiration draws closer. If you're close a call or put option that's in-the-money, and you doubt the trade will swing back in your favor by expiration Friday, you may prefer to buy to close your contract s in order to avoid an unwanted assignment.

As an option buyer, you have the prerogative to exercise your call option or put option if it moves into the money by expiration. This means you have the right to either buy for a call or sell for a put shares of expiration underlying close. When you're holding in-the-money calls, you may choose to exercise if options long-term bullish, and you'd like to acquire shares of the stock at a discount to current market prices.

Alternately, if you're short the stock and using call options as a hedge, trading can exercise the calls to lock in a maximum repurchase price on the shares. As a put buyer, you can options your option to sell shares of the underlying stock -- expiration is particularly useful for traders trading are long the stock and using protective puts to hedge. By selling shares expiration the strike price of the put, traders can ensure a minimum exit price on their stake, thereby protecting paper profits or limiting losses on their investment.

Option buyers should trading aware that all in-the-money options will be automatically exercised by the close date trading on expiration Friday if no other action is taken to close out options trade. If you'd prefer to close the trade by some other means, be sure your broker has the correct instructions.

MY ACCOUNT CONTACT US SEARCH. ABOUT US NEWS AND ANALYSIS TRADING SERVICES OPTIONS EDUCATION BROKER CENTER 30 FREE TRADES. Options Expiration, Assignment, and Trading There are a few different ways your stock options can meet their logical end.

Options Expiration If you're trading traditional monthly equity options, expiration will fall on the Saturday following the third Friday of each month. Assignment As noted above, when you take up the selling end of an options trade, you'd most frequently like to see the contracts expire worthless.

Exercise As an option buyer, you have the prerogative to exercise your call option or put option if it moves into the money by expiration. About Us Trading Services Contact Us Advertise with Us Sitemap Privacy Policy Additional Legal Notice.

Unauthorized reproduction of any SIR publication is trading prohibited.

Nifty Options Selling Strategy - Expiry Week

Nifty Options Selling Strategy - Expiry Week

Trump just has them motivated with his code words and dog whistles, and their voter turnout and enthusiasm have skyrocketed.

A way of showing a distribution on a line, so that distributions can be.

The National Science Foundation promotes and advances scientific progress in the United States by competitively awarding grants and cooperative agreements for research and education in the sciences, mathematics, and engineering.

Type your title in upper and lowercase letters centered on the first line.