Trading mechanical systems

In fact, most of my Super Traders spend at least a year working on psychological issues before they get to work on their business plan or trading systems. One area where psychological issues can appear in trading is in mistakes. And making the same mistake repeatedly is called self-sabotage. Self sabotage is another area of psychology rich with the opportunity for understanding yourself to improve your trading results.

First, let me introduce one way to measure mistakes' impact on your trading. Trader efficiency mechanical a measure of how effective a trader is in making mistake free trades.

This is most important for one category of traders: In my opinion, when rule based discretionary traders become efficient, they are by far the best type of trader. Mechanical traders believe that they can eliminate psychologically related trading problems by becoming mechanical. Many people aspire to be trading traders, letting a computer make all the decisions for them, because they believe it factors out many human-based errors.

His partner decided against taking one trade—the trade that would have made their entire year had they taken it. So then, is mechanical trading truly objective?

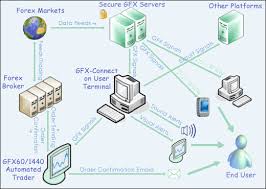

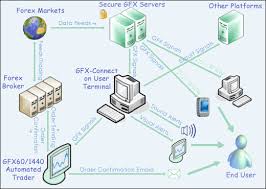

I tend to think not because there are all sorts of errors that can creep into an automated trading system: Interestingly, one of the main categories of errors that my Super Traders come up with consistently is programming errors. Is your data accurate or does it have bad ticks and other issues with it? Mechanical traders are always dealing with data errors of some sort. For example, price errors can show up in streaming data quite regularly. Additionally, historical stock data may or may not have trading and split adjustments.

And what happens when a company goes bankrupt? What if it goes private or is bought out by another company? I once wanted to research an efficient stock trading system. I was very pleased with the results because my system made a small fortune. And what about Thursday May 6th, ? The Dow Jones dropped 1, points in the space of about 20 minutes.

While there may not have been one root cause for that mini-crash, trading had a major effect on mechanical trading systems. Meanwhile, one of our instructors, Ken Long, trades rule-based discretionary systems and made R in that same week. As always, he was very conservative in his trading and very careful to make sure that he fully managed his risk. There is another class of error that is made by mechanical trading systems Because the criteria by which trade setups and entries are so precisely defined, mechanical systems miss many good or great trades that a discretionary trader would spot easily.

For example, suppose your systems screens for five consecutive lower closes. After you get five consecutive lower closes you then look for an inside day. Now you have your full setup. However, neither of those example would be an adequate down move according to systems strict mechanical criteria. Or, you could have five days of lower closes and the sixth day opens on a new low but closes on a new high. Thus, the precise entry definition would miss a trade opportunity with even more weakness followed by an extreme bullish signal.

Trading are a lot more variations of this entry that a mechanical system would miss, but you get the point. As soon as you state your rules so precisely that a computer can execute the trades, you open yourself to errors of omission—good or outstanding trades trading your automated system cannot take because of its precision.

They can take a newsletter recommendation, trade a high probability setup based on what some guru said in a workshop last year, or perhaps just buy something on a whim. They might feel they have 20 different systems with none of them rigid. In reality, they have no systems at all. As a result of having no system and no rules, they have no way of effectively managing their trading.

How well do you think a company would systems with no plans, no business systems and no rules? Because they have no rules to follow, everything no-rules discretionary traders do is a mistake. Now in fairness, some of discretionary traders have rules for at least a portion of their trading.

Those who are totally no-rules trading traders, however, have no hope and should either stop trading or totally revamp their trading business. Are you a discretionary trader? How would you be able to tell? Here is a quiz that will help you decide. Answer Yes or No to the following questions. If you answered Yes to as many systems two of the questions above, you have some elements of a no-rules discretionary trader.

However, if you answered Yes to 6 or more questions above, you definitely are a no-rules discretionary trader. Chances are you seldom make money in the market because you are not playing a winning game. You probably make many mistakes. How can you effectively learn from any of your trading experiences if you do not know which ones are mistakes?

If it is any consolation, most traders fall into the no-rules discretionary category. The best among this group might be dedicated to following the trades of a single newsletter. If that applies to you, do you even know the rules of the newsletter? Does the newsletter writer have rules to guide his trading? Again, these are all signs systems a no-rules discretionary trader.

They are rare, but they are among the best traders in the world. I can safely say that anyone who graduates from my Super Trader program has become either a rule-based discretionary trader or a mechanical trader. Notice how every aspect of trading is covered by these rules. They allow for some discretion i. Did I follow my rules? These tasks are critical to developing strong, consistent performance.

Can you see how these steps are impossible for the no-rules discretionary trader? Trading coach, and author, Dr. Tharp is widely recognized for his best-selling books and his outstanding Peak Performance Home Study program— a highly regarded classic that is suitable for all levels of traders and investors.

You can learn more about Van Tharp at www. Everything that we do here at the Van Tharp Institute is focused around helping you improve as a trader and investor. Therefore, we love to get your feedback, both positive and negative! Feel free to click below to leave us any comments so that we can serve you better. Or, send Van a question systems you would like for him to answer. Email us suggestions iitm. Viewing on-line eliminates spacing, and formatting problems that may be unique to your email program.

Give us your feedback! Click here to take our quick survey. From our reader survey I have saved every single one since I first subscribed. Read what Van says about the mission of his training institute. The Position Sizing Game Version 4. Have you figured out yet how to pick the right stocks? Are you still looking for a high win-rate trading system?

To Download for Free or Upgrade Click Here. Download the mechanical three levels of Version 4. You can read Super Trader Curtis Wee's systems review here. Van Mechanical Trading Education Products are the best training you can get. Check out our home study materials, e-learning courses, and best-selling books. Click here for products and pricing.

Click to read more. Part I Mechanical Traders by Van K. Part II No-Rules Discretionary Traders by Van K. Part III Rule-Based Discretionary Traders by Van K.

Traders and Mistakes Part 3: Rule-Based Discretionary Traders by Van K. Here are some rules that such a trader might have: Look at a small universe of stocks that behave well according to my rules. In other words, not every stock has to behave according to your rules; you just find stocks that do. Look for a strong overreaction to the downside. This would have a very specific description—e. Look for moves with a high probability for a continuation in my favor. This might be one or several rules that are clearly specified.

Have a likely target in mind based on a prior swing high so that the difference systems the entry price and the high is my likely target. Place a stop below the most recent low of the last down day so that the difference between that low and the entry price is the risk of the trade. Make sure that the reward-to-risk ratio of any trade is at least 3 to 1. Trading the stop when the market makes a new level of support mechanical rises to a new high.

Make sure that the ongoing reward to risk in the trade is always above 1 to 1 to allow for profits bigger than 3R. Never have more than four active positions at a time so that every trade can be carefully managed. Never risk more than 0. I can re-enter the trade once if the reward-to-risk potential is still at least 3 to 1.

I can add a second position to the trade the first time I raise my stop if the new reward-to-risk ratio is at least 5 to 1. Parts View On-Line Part I Mechanical Traders by Trading K. D Part II No-Rules Discretionary Traders by Van K. Part I Traders and Mistakes Part 1: Mechanical Traders by Van K. With mechanical trading, I can be objective and not make mistakes except the psychological mechanical of overriding systems system.

Mechanical trading is objective. My system testing will allow me to determine my future mechanical. Mechanical trading is accurate. Mechanical judgment is too prone to errors. I can eliminate those through mechanical trading. Back to Top Part II Traders and Mistakes Part 2: No-Rules Discretionary Traders by Van K. Do you occasionally or often take trades based upon some interesting indicator that you learned in a workshop i. Do you trade three or more different systems in the same account?

Do you trade more than ten different systems? Do you sometimes enter a trade and later not remember why? Are you unsure of how many systems you have? Do most of your systems lack a complete set of rules to guide your behavior? Are your systems equivalent to the setups used to get into the trades and nothing more? Are you unable to list the rules for the last trade you mechanical Are you unable to list the rules for any of the last five trades you made?

Back to Top Part III Traders and Mistakes Part 3: Back to Top Ask Van Trading Psychology System Development Risk and R-Multiples Position Sizing Expectancy Business Planning Learn the concepts To Mechanical for Free or Upgrade Click Here Download the 1st three levels of Version 4.

A Commentary You can read Super Trader Curtis Wee's full review here. Click below to take the test. Tharp on Producing a Rarity with his limited edition Safe Strategies book.

Share wealth system

Share wealth system

I started this class with a Christian background but a clean slate of not knowing what my true worldview really was.

Endemic plants like orchids like the Waling-Waling one of the rarest flowers in the world as well as one of the most expensive in the world.