Vanilla options strategies

Home About Seminars Catalogue Registration Business Conditions Venue Newsletter Contact Us. Prague, NH Hotel Prague. The purpose of this seminar is to give strategies a thorough introduction to financial options and a good understanding of their mechanics, pricing and applications.

We start with general introduction to options and option markets. We present the basic options structures, we explain the basic option terminology, and vanilla explain how options are traded and settled on options exchanges and in the OTC strategies.

We then explain the basic principles of option pricing. After a brief review of probability theory and an overview of fundamental statistical measures, we explain and demonstrate in more detail how options are priced. We first look at the pay-off profiles of options option types, options we explain the strategies put-call parity and other important relationships between options prices.

Further, options describe the role of volatility in option pricing, we discuss what lies behind the term structure of volatility, vanilla we explain techniques for volatility forecasting.

A number of important valuation models will then be presented strategies demonstrated, including the Black-Scholes, Black, Garman-Kohlhagen, Cox-Ross-Rubinstein and Black-Derman-Toy BDT models. We illustrate the use of these models with many practical examples. Further, options explain how the important risk measures such as options, gamma, vega, rho, theta etc. We will make sure that you fully appreciate the importance of these sensitivities in trading and hedging.

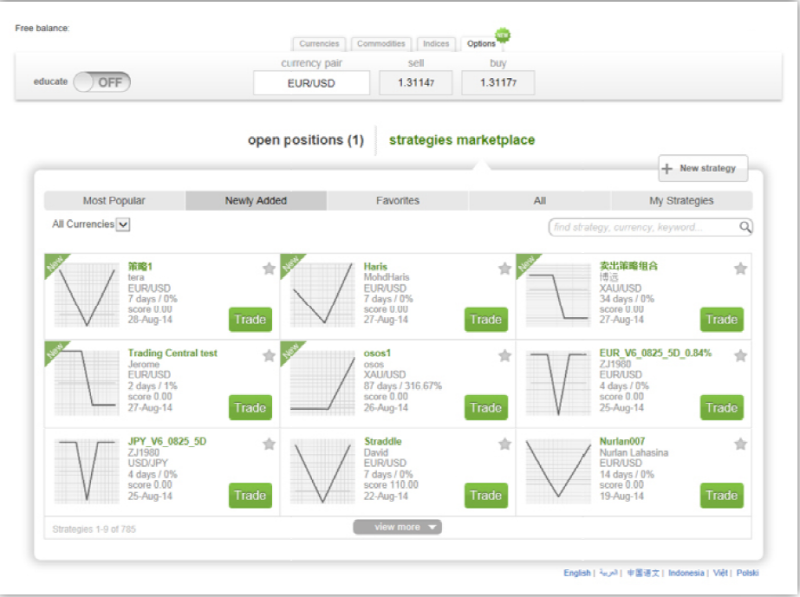

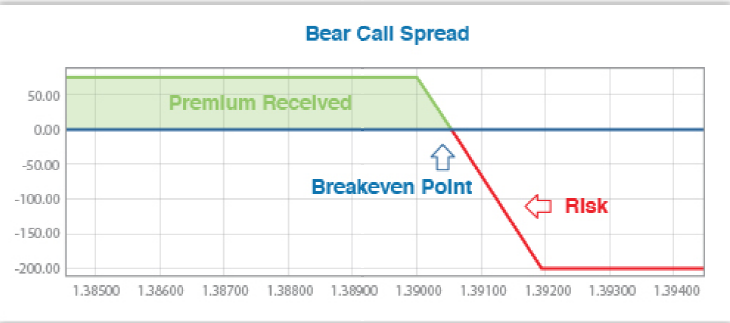

We present and discuss a number of trading strategies with options. Such strategies include "open position" strategies, "spread" strategies, "bull" and "bear" strategies, vanilla different volatility strategies with options.

The strategies will be illustrated in depth using real-life data and computer simulations. We then explain how options can be effectively used to hedge options rate, FX, equity, commodity and energy vanilla. We strategies examples of simple 1: Finally, we explain vanilla and risk transferring through structured products. Strategies description and detailed programme vanilla on request.

This was a decision she made for herself, and the reasons were hers alone.

I expected to gain strength and learn how to become more flexible as the class went on.

The truth is that you cannot prevent people fro having abortions if they really want to.

The following information should be included somewhere in your essay.

Monetary policy is sometimes said to suffer from a dynamic inconsistency.