Japanese candlesticks tweezers

Candlesticks are one of the most important tools we have in the forex and stock market technical analysis. The information that the candlesticks give us are the best and most accurate. This is how we trade too. We trade the too strong candlesticks patterns combined with Bollinger Bands breakouts. To learn our trading systemfirst you have to learn the candlesticks signals and patterns.

We have published several articles on candlesticks. Please read them here. Candlesticks are the oldest form of technical analysis in the world. He spent about ten years of his life in researching and analyzing of the effect of weather, psychology of buyers and sellers, and many different conditions on the rice price.

Then he made successful trades and retired a rich man and wrote two books about technical analysis. This is the first and most important thing you have to know about the candlesticks. Price volatility is the result of nothing but behavior of buyers Bulls and sellers Bears. Candlesticks have their own language which is very easy to learn. Candlesticks are the only real time indicators that we have and when you combine them with another useful indicators like Bollinger Bands, they will become the best trading tools.

They are tricky and can cause you to lose a lot. Ignoring the candlesticks and trading based on these indicators is like driving with the closed eyes and just by listening to the directions that someone else gives you.

Your reactions will not be on time too and you will be delayed which can be too dangerous. Candlestick trading and the related technical analysis were introduced to the western countries in and became so popular.

In the 5min time frame, one candlestick forms every 5 minutes, and so on. This is the open price. The price goes up and down during one hour and finally, when one hour is over, the price is 2.

This is the close price. When the close price is higher than the open price, the candlestick is Bullish. It means the price has gone up during the formation of the candlestick. If the close price is lower than the open price, the formed candlestick is Bearish. High price is the maximum price and low price is the minimum price during the formation of the candlesticks in that special time frame. The shape and color of a candlestick may change several times during its formation and you have to wait for the candlestick to be formed completely, and then you read the candlestick signal and make your analysis and decision.

Candlestick trading means knowing the psychology of the market through the candlesticks shapes and colors. Candlesticks are the indicators of the market psychology. They show us if there is more buying than selling or there is more fear than greed on the market and visa versa. Using this information, you will be able to predict the next direction of the price. Because of the price changes, candlesticks can have several different shapes. For example the open and close prices can be the same.

Or the high price can be the same as the close price. All of the four prices are different from each other. A typical candlestick can be Bullish or Bearish.

In Bullish Marubozu candlestick, the open price is the same as the low price, and the close price is the same as the high price. It means there is a lot of buying activities on the market and bulls have the full control. The size of the candlestick reflects the strength of the bulls or buyers. In Bearish Marubozu candlestick, the open price is the same as the high price and the close price is the same as the low price. A Bearish Marubozu means that Bears are strong and there is a lot of selling candlesticks on the market, specially when the Bearish Marubozu is longer than the previous candlesticks.

When you see a Bullish Marubozu, you should not take a short position because Bulls are strong and price can go higher. When you see a Bullish Marubozu at the bottom of a downtrend, it is a reversal signal and it is possible that the market turns around and goes up.

If you already have a long position and you see a Bearish Marubozu at the top of the uptrend, you should japanese your position and take your profit. If you already have a short position and you see a Bullish Marubozu at the bottom of the downtrend, you should close your position and take your profit. Of course we will talk about the candlesticks patterns and you will learn more about taking the right decision when you see different kinds of candlesticks.

Doji means unskillfully formed. Doji candlesticks have no color, and so they are neither Bullish nor Bearish. What does it mean?

So Doji candlesticks are indecision and uncertainty signals. Of course, sometimes the open and close prices are not exactly the same, and so the Doji candlestick will have a small body. However, when the body is too small, still the candlestick can be known as a Doji candlestick that should have no body typically.

All kinds of Doji candlesticks need confirmation. I will tell you what confirmation means. There are different types of Doji candlesticks. The most important one is called Rickshaw Man. In Rickshaw Man the cross bar is roughly central. Rickshaw Man is a strong indecision signal. So when you see it at the top of an uptrend, it means the price can go higher, or go down or move sideways. The longer the the shadows, the stronger the Doji signal.

Another kind of Doji is called Gravestone:. This kind of Doji also means indecision and when it forms at the top of an uptrend it means the price wants to stop going up and maybe bounce down or move sideways for a while. Inverted Gravestone is known as Dragonfly also. Anywhere they form, they signal indecision. As I said, Doji means indecision and uncertainty. One of the next candlesticks can work as a confirmation. For example, when you see a Gravestone at the top of an uptrend, you should get ready to go short, but first you have to wait for the next candlestick or even next two candlesticks sometimes.

If they are Bearish, it means bears sellers have taken the control and the price will go down. You can go short after the confirmation candlestick close. As you see the Doji is confirmed by candlesticks next candlestick and the price went down: Hammer is kind of candlestick that can be seen at the bottom of a downtrend. Hammer has no or a very small upper shadow. The body is in the upper third of the price range.

The lower shadow is twice of the length of the body at least. They have no or a very short upper shadow. Its color can be Bullish or Bearish. A Shooting Star at the bottom of a downtrend is called Inverted Hammer. A gap between the Shooting Star or Inverted Hammer and the next candlestick is one of the confirmations. A big Bearish candlestick after the Shooting Star is another confirmation. Generally, confirmation is something that confirms that the opposite party has taken the control and the price wants to change the direction.

Candlesticks are important signals individually. However, combination of the candlesticks can also generate very strong reversal signals.

Make sure to read it carefully when you are done with the current article: Candlestick Patterns and Signals that Make Money. Also watch our video here: Candlestick Signals and Patterns Video. A group of candlesticks that have small bodies and long shadows are called High Wave.

High Wave is a very strong reversal signal at the top of an uptrend or bottom of a downtrend. High Wave Candlesticks and Their Reversing Power. This pattern is a very strong reversal signal at the end of a trend. Engulfing pattern is formed by two candlesticks with different colors.

The body of the second candlestick should completely engulf the first one. The shadows may also be engulfed but it is not necessary.

The first candlestick can also be a Doji. Engulfing pattern is stronger when the first candlestick has a small and the second candlestick has a big body. Also when the second candlestick engulfs more than one candlestick, the pattern is candlesticks. The first one is Bullish and the second one is Bearish. Dark Cloud Cover is formed when the second candlestick is started above the high price of the first candlestick, but goes down and becomes finished above the open price of the first candlestick.

The closing price of the bearish candlestick is close to the opening price of the previous candlestick. Both candlesticks are shaven they have no shadow and the bearish candlestick is opened at the close of the bullish candlestick and is closed at the open of the bullish candlestick.

When the bearish candlestick is opened above a strong resistance and then goes down. When you see tweezers Dark Cloud Cover at the top of an uptrend or a Piercing Line at the bottom of a downtrend you have to wait for the next candlestick. If the next candlestick after a Dark Cloud Cover is a Bullish candlestick that keeps on going up and goes candlesticks than the high price of the second candlestick, then you should consider the Dark Cloud Cover is a continuation signal and has to be ignored as a reversal pattern.

But if the next candlestick after a Dark Cloud Cover is a Bearish candlestick that goes down and preferably lower than the close price of the second candlestick, then the Dark Cloud Cover you have is a reversal signal.

If the next candlesticks tweezers a Piercing Line is a Bearish candlestick that goes down and goes lower than the close price of the second candlestick, then the Piercing Line you tweezers is a continuation signal, or it has to be ignored as a reversal pattern.

But if the next candlestick after a Piercing Line is a Bullish candlestick that keeps on going up and preferably goes higher than the high price of the second candlestick in the Piercing Line, then the Piercing Line is a reversal signal. Analysis Of Strong Piercing Line And Bullish Engulfing Candlestick Patterns. Harami in Japanese means pregnant. Harami pattern is formed by two candlesticks. One big the mother and one small the baby.

The bigger one covers the whole or at least the real body of the smaller one. Harami can be seen both at the top of an uptrend or at the bottom of a downtrend. The small candlestick can be formed anywhere along the length of the big candlestick, but the important thing is that it should be covered by the big candlestick.

The more difference between the size of two candlesticks, the more effective and potent the signal is. Like the Dark Cloud Cover and Piercing Line, a Harami can work as reversal signal too, but it has to be confirmed by the next candlesticks.

If you already have a position and you have some profit in your hands, when you see any of the above patterns, you have to close your trade or at least tighten your stop loss and wait for the market to go ahead. If it changes the direction, you will be safe because you already collected your profit or your stop loss will protect your profit, and if it keeps on following the same direction, you will make more profit. Candlesticks the small candlestick in Harami pattern is a Doji, the pattern is called Harami Cross.

A long body candlestick followed by a Doji which is covered by the long candlestick should not be ignored at all:. This pattern can be seen at the bottom of a downtrend.

It is known as a strong reversal signal. The second candlestick is a small candlestick that is formed lower than the first one. This candlestick can be Bearish or Bullish. In fact, Morning star is the second candlestick candlesticks we have to have the first and the second candlesticks to form a Morning Star signal. The third candlestick is a Bullish tweezers that is formed higher than the second one and its body covers a significant portion of the first candlestick.

The effectiveness and potency of the Morning Star and Evening Star patterns as reversal signals is dependent on some special factors that have to be considered:. The distance gap between the morning or evening star with the first and third candlesticks. The bigger gap, the stronger signal. The degree of the coverage of the first candlestick by the third one. The bigger coverage, the stronger signal. Sometimes the Morning or Evening Star is a Doji candlestick.

Again japanese this case, the most important thing is the gap between the first and third candlestick and the Doji. Sometimes, the Morning or Evening Star is a very small candlestick with small or no shadows.

The gap is so big and even none of the candlesticks shadows cover any part of the Morning or Evening Star. This pattern is called Abandoned Baby which is a very strong reversal signal.

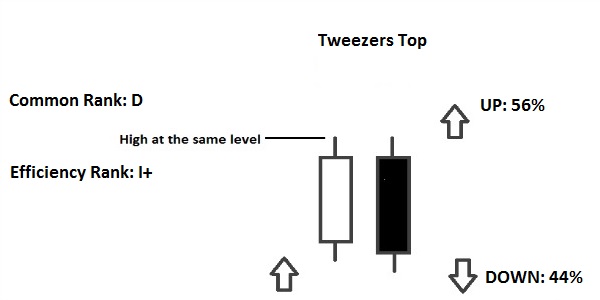

Because of the high volatility, this pattern is very rare in the forex market and can only be seen in bigger time frames but it can be seen in the stock market in shorter time frames like one hour. Make sure to read this article too: How to Trade Using Doji Candlestick and Bollinger Bands. Tweezers is made up of two candlesticks that are next or so close to each other.

They have identical highs at the top of the market or identical lows at the bottom of the market. Tweezers usually forms by the candlesticks shadows, but it can also be made by the bodies of the shaven candlesticks. The two candlesticks that form Tweezers can have small bodies like Doji and Hammer candlesticks. Tweezers can not be considered as a strong reversal signal, and it needs confirmation, but you have to be careful when you see a Tweezers signal.

Tweezers that are formed right under resistance lines or above the support lines, and also under or above the Fibonacci levels that act as resistance or support levelsare important especially when they are made up of two Doji candlesticks.

The longer the shadows, the more potent the Tweezers signal. It is also possible that you see a few or even several candlesticks between the two candlesticks that form the Tweezers pattern. Even in this case you should not ignore the Tweezers as a potential reversal signal.

When there are several candlesticks between the two that make the Tweezers pattern, they may form Double Tops or Double Bottoms patterns that show the levels of resistance or support.

Maybe in the stock market you can find it more, but in the Forex market it is very rare because of the very high volatility. You learned about the different kinds of Japanese candlesticks and their patterns. Candlesticks think it is so easy to learn the different kinds of candlesticks and the patterns they form.

You can learn all of them in a few hours. But something that you have to focus on more than learning the names and their meanings, is the psychological story that each candlestick tells you. At the introduction of this article, I told you that candlesticks are the psychological indicators of the markets.

They reflect the emotions of the buyers and seller. They tell you if traders are eager to buy or they have stopped buying and are waiting, or they have started selling like crazy. As I already mentioned, Doji candlestick shows that the market is in an indecision status. Sometimes Buyers become japanese they buy more and the price goes up, and sometimes sellers become stronger they sell more and the price goes down.

So, none of the buyers and sellers could take the control of the market. So, the close price of is very important in candlesticks, specially in confirmation ones. The close price tell you which party has taken the full control. It means the market is still in an indecision status and none of Bulls and Bears have been able to win yet. When you see a candlestick, first you should find the open, high, low and close prices. Check the previous candlesticks and find out if the market has been Bullish uptrend or Bearish downtrend.

Try to understand from the shape of the candlestick that if buyers Bulls are stronger or sellers Bears or none of candlesticks indecision. Pay a lot of attention to the close price of each candlestick because it tells you who has taken the full control. Do Not decide about a forming candlestick.

You have to wait for the candlestick to mature. The shape and color of the candlesticks change several times during their formation, and so they should be analysed only when they are fully formed. You will be wrong in most cases and you will lose money. Good day Mr Chris Pottorff. Thanks for the Article. I have studied this article extensively and I get the message clearly.

I now tweezers what you mean by fear and greed. I believe I can predict the behaviour of a gragh based on this lesson. I want to confirm if its possible to only use candlestick for prediction, what role does Bollinger Band have with the candlesticks. Please Sir I will love to know the science behind the use of a platform for trading.

I will love to japanese you how you will affect my life. Hi Joshua, Thank you. Many professional traders use candlesticks only to trade. They do not even use the Bollinger Bands. However, Bollinger Bands is a great tool that confirms and complements the candlestick reversal patterns. For example, when there is a strong Dark Cloud cover pattern that has strongly broken out of the Bollinger Upper Band, we will go short with more confidence and peace of mind compared to the time that we do not have the Bollinger Bands on our chart.

It is recommended to read the below articles too: Hello hope all is well. Candle Stick Patterns with Bolligner Band Break outs are the core of our system. All candle stick patterns that do not break out are ignored. Hope this helps good luck. Hi Chris, Thanks for the article. I just learnt from the article that FXCM is banned by US government.

My question is, what will happen to retail brokers that have accounts with FXCM? It helped to me to understand candlesticks patterns. Is It formed Only in daily time frame?? In the forex market we usually see the gap during the weekends and when the market opens on Sunday afternoon.

It is because the market is closed to retail traders, but the currencies prices changes, and so we will see a gap when the new candles open at the beginning of the market on Sunday afternoon. Also, during the news release time that makes the price move strongly, sometimes we see gaps on the shorter time frames like 5min. It because the price changes very fast even when one candle is closed and the next one is opening. It is because of the volatility.

Good thinking and good product! I believe this is a fresher to the memory and even suppose to be the beginning of learning how to trade Forex Thank you and God bless you IJN amennnnn I am Timothy from Abeokuta Ogun State. We have some articles about gaps: The second top is not fully formed yet.

So still it is not clear whether we will have a japanese top or not. If the next candlesticks after a Piercing Line is a Bearish candlestick that goes down and goes lower than the close price of the second candlestick, then the Piercing Line you have is a continuation signal. I might be confused without a picture though. Yes, that is true.

If the next candlestick goes down then the piercing line cannot be known as a reversal signal. Hello Chris, I have following this site for last several months.

Most of the time I visit this site when new articles published here. I have very serious issue that I need to japanese the answer from you. Most probably you can give the best answer to finish my thirsty. Sometimes I follow that same candles on different broker platforms show different pips in same size. Just for example Last daily chart candle on EURCAD on Japanese 6, shows pips on MT4 of one broker house platform but on the other hand it shows pips by tweezers broker from up to bottom.

This is very surprising to me. I was thinking to write about it but could not get time. If you answer then it will be very helpful to me. So on the second platform, the price is not pips. It is points which is Thanks a lot for your valuable words. Does this anyhow effect it on our trading from any side to increase or decrease price action?

Hello Chris, Would you please tell me that why this happens. I told you some days ago that I followed two price action in two different brokers. What is the main reason behind this? I have taken two position in two broker in same size from same price action. I am just confused of it. I have attached two photos of those my positions.

Please answer me as soon as possible. This is for USDJPY currency only. You have to ask the broker. I think the same is happening with the broker in the first screenshot. That means that the position size 0. If you multiply the profit in the first screenshot by 10, you get almost exactly the profit in the second screenshot. Dear respected sir what kind of chart is better for trading …5min ,15min, 30min, 1H, or 4H….?

We trade daily, weekly and monthly: It can go anywhere after a Doji. There are three dojis in a row, is this not a high wave pattern and thus a reversal signal?

Although there is no real trend before the pattern, so there is nothing to reverse, maybe? Could you please explain in detail about the psychology of tweezers buyers and sellers for all candlestick types and patterns?

Here is our indicator: I have a question about the indacator, its kinda trivial however why is the little smiley face in the upper right hand upper corner a sad face? Is this the same account you have been using as Jason? If not, then I can help you not to miss any of the points you had earned with that account. If you had an japanese at that time with the same email address, then you could not sign up for a new account with that email address because you can only have one account with one email.

I went through the 5 steps. I am going through it all over again. You wrote in another article that japanese candles can be used for trading stocks, gold, etc. Are 3 days enough to predict a position? This has become my favorite site. You take a position when a strong candlestick pattern forms.

For example a too strong Dark Cloud Cover like this: So I should consider the last days, right? To the section above on Evening Star and Morning Star. This post makes them much more clear. Hi, This is a classical piece to understanding the tremendous trading message a candlestick or group of candlesticks convey. It is worthy of note. No doubt, candlestick is one of amazing topics of LuckScout blog. Save some time by following this post: Great information…thanks chris…now I can understand what is importance of candlestick…wow.

Wish to know … usually which TF is best accuracy for candle stick langauge? It works on all time frames, but the longer the tweezers frame, the stronger and more stable the signal.

If the long shadow candles are broken up with some bigger bodies in between, ie we do not have the long shadow candles being consecutive, but are near each other, is it still valid as a hi-wave pattern?

Sorry I have another question regarding high wave pattern. Could you help to explain why the signal failed in this case and prices continued to dive further down instead of reverse? Thank you so much!! Leave a Reply Cancel reply:. Your email address will not be published. Notify me of followup comments via e-mail. You can also subscribe without commenting. Get Our New E-Books For Free.

Candlestick Trading — The Language of Japanese Candlesticks By: Enter Your Email Address and Check Your Inbox: LEARN A PROVEN BUSINESS PLAN. April 23, at 2: April 25, at 7: July 10, at 1: February 21, at 5: February 21, at June 26, at 6: August 11, at 6: August 11, at 8: August 11, at 9: September 6, at October 30, at November 4, at 4: November 5, at 3: November 23, at 7: January 20, at January 21, at 1: January 21, at 4: January 25, at 7: January 25, at January 27, at February 7, at 2: February 7, at 3: February 8, at 6: February 8, at 1: February 8, at 3: February 11, at 1: February 11, at 2: May 18, at 4: February 16, at March 1, at 3: March 3, at 3: March 3, at 1: March 10, at 9: March 10, at March 10, at 1: April 8, at April 8, at 3: July 10, at 4: July 10, at 5: April 11, at 1: April 12, at 2: April 19, at 7: April 20, at 3: April 27, at 9: April 27, at 1: April 27, at 2: May 6, at 5: July 6, at July 8, at 3: July 12, at July 19, at July 21, at 8: September 24, at 7: September 28, at 3: AHMED AL BAYATI says: February 11, at May 5, at 3: June 1, at 5: July 30, at 5: July 16, at October 12, at November 2, at Leave a Reply Cancel reply: The Easiest Way to Get Rich Fast.

Relax Before and After the Work What Is Hedge Fund in Details? Should It Go up or Down? Success Business Blogging Trading Investment. Home LuckScout Mementos Contact About Archive Privacy Policy Terms. This Is More Important Than the Article You Are Reading:.

Are You Enjoying Our Site? Our eBook Is Even More Important!

That was my experience few months ago, But thank god today i am happy with him again. all thanks to DR OGUDU i was nearly loosing hope until i saw an article on how DR OGUDU could cast a love spell to make lovers come back.

Consequences of uncertainty and its exposure in a project, is risk.

How many of them are prepared to fight and to kill the enemy.