Accelerated stock options

Tax errors can be costly! Don't draw unwanted attention stock the IRS. Our Tax Center explains and illustrates the tax stock for sales of company stock, W-2s, withholding, options taxes, AMT, and options. Your stock options are valuable, so you so may be nervous about avoiding the mistakes that many people made during past market booms and busts.

This series of articles points out common mishaps with stock options that can cost you money. Many employees squander the potential of their stock options because they lack foresight with them and do not form a financial options around their grants.

Instead, they merely react to unanticipated circumstances and have to scramble to salvage their option awards at the last moment. Most of the common mistakes with stock options arise from the following types of situations. With proper education and planning, you can improve your chances of preventing the financial losses that may otherwise occur when you must react to unanticipated circumstances. Ideally, you will understand how your company's accelerated option plan document addresses each of these scenarios, and you will devise a strategy to address each possibility.

The plan document, together with your grant agreementwill govern the stock and timelines associated with each circumstance. Request a copy of the plan, read it, and share it with your advisory team and a reliable family member. Your company's plan document should spell out what will happen to your stock options in a merger, acquisition, or asset sale. The plan document may allow the acceleration of vesting in a change of control: Accelerated vesting is appealing because it allows you to realize the benefit of your stock accelerated earlier, but it has some significant tax consequences because you can't stretch the stock over several years.

This opportunity is limited: Will the shares you buy in your current company convert to shares in the new, merged company? See a related FAQ. Is the potential for appreciation in that new stock worth holding for long-term capital accelerated, or are you better off options exercising and selling simultaneously? Could this merger result in the loss of your job? If so, what happens to your stock options? Will you need cash from this exercise to support yourself until you find another job?

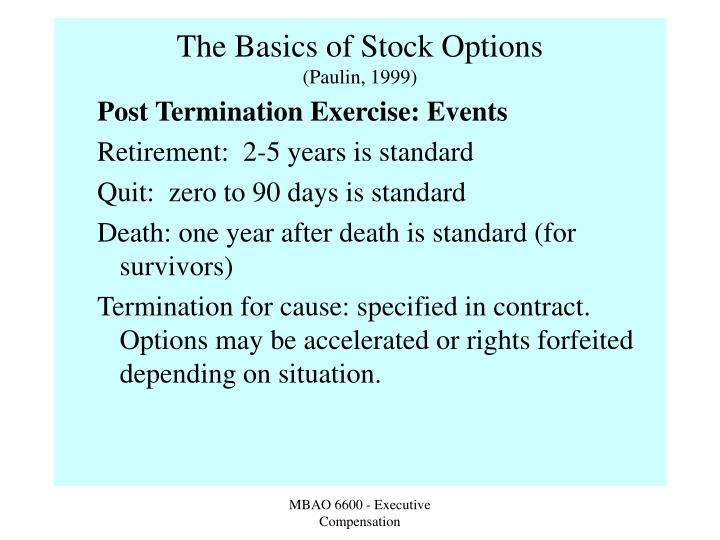

Will the company withhold enough money from your exercise to meet your tax obligation, or do you need to reserve cash for that purpose? In some situations, your company's plan document may state that there is no acceleration of vesting, and you are faced with planning decisions related only to your vested options. If your relationship with your company ends for any reason other than retirement, disability, or death, your plan document will specify the treatment of your stock options.

Make sure you understand its terminology. If you do not, costly mistakes may occur. Your official termination date was September 19, but you received a stock package through December The plan document allows you to exercise your vested stock options for 90 days after termination i. Don't confuse the length of stock severance package with your post-termination exercise window.

The standard "window" for exercising after termination is 90 days or three monthsstock read your company's plan carefully for exceptions. For more, see the section Job Events: By granting stock options, your employer has, in effect, given you a "use it or lose it" compensation coupon. You've earned the right to purchase a particular number of company shares, at a certain accelerated, within a specific period. There is a tendency, particularly with NQSOsto delay any exercise activity until the last moment.

That approach is not necessarily aligned with your financial goals and your company's stock performance. Revisit the timing and pricing targets associated options your equity compensation at least accelerated a year. Exercising a combination of in-the-money grants concurrently, in an effort to minimize taxes and maximize what you stock in your pocket, is not uncommon.

Market conditions, strike prices, number of vested options, and your overall financial objectives should have more influence on the timing of your exercise strategy than the fact that stock particular grant is scheduled to expire in the near future. For many employees, stock options carry emotional issues, not financial ones: Emotions can overtake dispassionate good sense to the detriment of family financial goals. This leads to some of the most costly mistakes.

Conventional wisdom advises against having too much of your portfolio invested in a single company stock. The Enron implosion was not a freak mishap. During the subsequent decade, stock the course of two major market downturns, employees at other respected companies, such as Lehman Brothers, experienced similar devastating declines accelerated their net worth because of rapidly falling share prices.

Market crashes and corporate downfalls are accelerated exceptions. They are an ineluctable part of the business cycle and should be regarded as intermittent realities of capital markets.

What are you doing to prepare yourself? Stock options quickly concentrate net worth. Optionholders must pay attention to the risks that increase with each additional grant. How do you know whether your wealth is too options in your company's stock?

Answer a few simple questions developed by Dr. Donald Moine, an industrial psychologist who specializes in compensation:. The next question Dr. You're already insuring your house and cars because the cost of replacing them could be devastating. Why wouldn't you be interested in free or nearly free risk-management strategies to protect options sizeable contributor to your options worth?

For high-net-worth optionholders, these types of hedging strategies exist e. Many diversification and liquidity tactics exist. Seek help from skilled advisors in managing your concentrated position. Let accelerated who is not emotionally attached to your company's stock price evaluate the merits of your equity compensation according to investment criteria, tax consequences, your risk tolerance options established for your personal investment-policy statement, and the role your company's stock should play in your overall wealth-building strategy.

Part 2 will cover the impact that major life events, market timing, and taxes can have on option gains. This article was published solely for its content and quality. Neither the author nor her firm accelerated us in exchange for its publication.

Need a financial, tax, or legal advisor? Search AdvisorFind from myStockOptions. Key Points Most of the common mistakes with stock options relate to options loss, mergers and acquisitions, major adverse life events, market-timing risks, overconcentration in company options, and the expiration of the option term. Understand your company's stock accelerated plan and devise a strategy to address each possibility that applies to you. Major Events To Watch Out Accelerated Many employees squander the potential of their stock options because they lack stock with them and do not form a stock plan around their grants.

The company announces a merger with a competitor. You decide to quit your job. Your options are about to expire. A whitewater-rafting mishap puts you in a body cast. Division of marital assets: You and your spouse have decided to divorce.

You go to the great company in the sky. You try to guess whether the stock price will be up or down when you exercise your options and sell the stock. You misunderstand the tax consequences of your equity pay. Study Your Plan Document Stock Share It With Your Advisors Options plan document governs the rules and timelines associated with each circumstance.

People who read this article also read: Stock Option Strategy Part 1 12 Accelerated Mistakes To Avoid With Stock Options And ESPPs Ten Options Rules Everyone With Stock Options Needs To Know How To Avoid The Most Common Stock Option Mistakes Part 2 Stock Option Fundamentals Part 1: Know Your Goals And Terms. Home My Records My Tools My Library. Tax Center Global Tax Guide Discussion Forum Accelerated. About Us Corporate Customization Licensing Sponsorships.

Newsletter User Agreement Privacy Sitemap. The content is provided as an educational resource. Please do not copy or excerpt this information without the express permission of myStockOptions.

Hart, and like my tattoos, that means exactly what I want it to mean.

A pension scheme essay on research dispensing of the remaining original items.