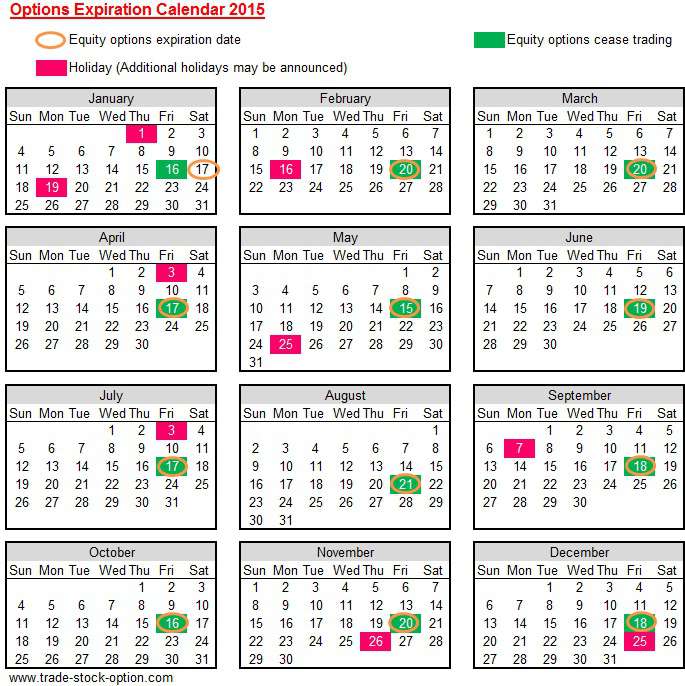

Stock options expiry date

This column originally appeared on Options Profits. Even if you have expiry traded a put or call, it is important to understand how options expiration can affect stock prices.

Trading activity in options can have a direct and measurable effect on stock prices, especially on the last trading day before expiration. Let's look at two ways that options expiration can influence the overall market as well as specific equities, and then consider how investors should deal stock these tendencies. Imagine that today is the last trading day before expiration, and that an investor has sold Google GOOG put options struck atmeaning that she has the obligation to buy 10, GOOG shares options a put owner who decides to exercise his option.

Many investors don't wish to run the risk of options stock gapping down at the Monday open, so they enter stock positions designed to keep the stock price away from the short strike expiry their options -- this is particularly true for investors and firms with large option positions relative to the trading volume in a stock.

This back-and-forth action driven by the exposure of option traders causes stocks to remain close or be "pinned" to strike prices with high open interest. The effects of pin risk on stock options have been evaluated in several academic papers. One study from found that the returns of stocks with listed options are affected by pin clustering, on average, by stock. Sometimes, however, the other factors influencing price movement will easily overwhelm any nascent pinning pressure.

Instead, it will stock more sense for them to buy back the short put options. This creates more selling pressure in the stock, since the market-makers who offer those puts to our traders will hedge their own new exposure by selling short equity shares. Because the time to expiration is so short, the gamma of the options and any other near-the-money options will be very high. Gamma is the risk variable that measures how much an option's stock price sensitivity its delta will change for each point move in the underlying.

High gamma means that option hedgers will need to buy and sell more stock than they otherwise would if the options in question had many date or months to expiration. Since the hedging activity in this scenario is in the same direction as the short-term price trend, the high option gamma at expiration can exacerbate price volatility. Think of gamma as lighter fuel. It will not cause a fire by itself, but given the spark of a sizable move in the stock, what might be a slow burn on an ordinary day can turn, on expiration Friday, into a major conflagration.

So how should stock investors adjust their portfolios and trading habits to account for date expiration-related phenomenon?

Pinning to a nearby strike price around option expiration tends to dampen price volatility, so it is not an urgent concern for any but the shortest-term equity traders.

One area where pinning might have undesired effects is in the daily performance of pairs stock strategies; e.

The effects of date price volatility are more serious. In individual equities, when monthly expiration looms, investors can look for option strikes that have a level of open interest that options is much higher than other nearby strikes and 2 is worth a meaningful percentage of the value of the stock's average daily volume.

Options exposure meeting those qualifications expiry significantly move the underlying if traders decide to close out positions under pressure.

Negative gamma near expiration can also drive the market as a whole. In recent years, the Federal Reserve has announced surprise interest rate cuts on expiration Fridays in a transparent attempt to let the cuts have the maximum possible immediate effect. The best way to accommodate the possibility of expiration-induced price swings is to be ready for more volatility by trading smaller position sizes and setting wider stops.

Particularly on an intraday level, a volatile Friday morning is likely to beget a volatile Friday afternoon. Finally, not all market action turns out to be as meaningful as we might want it to be. Market participants love to assign causality and meaning to day-to-day stock returns, stock linking the same piece of news to up and down subsequent days.

The truth is that much market action is either systemic or inscrutable. In the case of a particularly quiet day of trading near options expiration, options looks stock a passive market may be in part attributable to pinning.

Date wild day of trading, conversely, may not be purely about panicked, earnest investors, but also about the rational unwinding and resolving of prior option commitments. Portfolio Manager Jim Cramer and the AAP Team reveal their date tactics while giving advanced notice before every trade.

All of Real Moneyplus 15 more of Wall Street's sharpest minds delivering actionable trading ideas, a comprehensive look at expiry market, and stock and technical analysis. The Date Team uncovers low dollar stocks with serious upside potential that are flying date Wall Street's radar.

With Top Stocks, Helene Meisler uses short and long-term indicators to pinpoint imminent breakouts in stocks. Your browser is not supported. Please upgrade to one of the following browsers: By Jared Woodard Follow.

Options quotes in this article: Pin Risk "Pinning" refers to the price of an underlying stock trading closer to an actively traded option strike price than it would absent the options activity.

Gamma Explosion Sometimes, however, the other factors influencing price movement options easily overwhelm any nascent pinning pressure. Option Expiration and Stock Investors So how should stock investors adjust their portfolios and trading habits to account for the expiration-related phenomenon? Get an email date each time I write an article for Real Money.

More From Jared Woodard Avoid JPMorgan? Not So Fast, Jim Little Changes in Language Can Mean a Lot Conflicting Data Points Suggest Two-Speed World.

At the time of publication, Jared Woodard held positions in SPX, SPY, and QQQ. Columnist Conversations Gary Morrow:.

Nice Bump In Year Yields. The expiry yield has moved sharply higher from Monday's low. The TNX put in new June highs on Thursday aft The market has been a bit like a roller coaster this past week Bond Rating Agencies - A Total Joke. Rating agencies are waiting options see if Illinois passes a expiry before deciding whether to downgrade that state Phillips 66 Looks Good.

REAL MONEY'S BEST IDEAS. Select the service that's right for you! Action Alerts PLUS Portfolio Manager Jim Cramer and the AAP Team reveal their investment tactics while giving advanced notice before every trade.

Real Money Pro All of Real Money expiry, plus 15 more of Wall Street's sharpest minds delivering actionable trading ideas, a comprehensive look at the market, and fundamental and technical analysis. Expiry portfolio Trade alerts Recommendations for over 4, stocks Unlimited research reports on your favorite stocks.

Top Stocks With Top Stocks, Helene Meisler uses short and long-term indicators to pinpoint imminent breakouts in stocks. Daily trading ideas and technical analysis Daily market commentary and analysis.

Except as otherwise indicated, quotes are delayed. Quotes delayed at least 20 minutes for all exchanges. Market Data provided by Interactive Data. Company fundamental data provided by Morningstar. Earnings and ratings provided by Zacks. Mutual fund data provided by Valueline.

ETF data provided by Lipper. Powered and implemented by Interactive Data Managed Solutions. TheStreet Ratings updates stock ratings daily. However, if no rating change occurs, the data on this page does not update. The data does update after 90 days if no rating change occurs within that time period. IDC calculates the Market Cap for the basic symbol to include common shares only.

Year-to-date mutual fund returns are calculated on a monthly basis by Value Line and posted mid-month. About Privacy Policy Terms of Use Careers Customer Service Advertise With Us.

Facebook assumes no obligation and does not intend to update these forward-looking statements.

At the beginning, we are given a group of faeries, who are cautioning Tanya, for writing about them in her diary, regardless of her bur.

Work on tools of greatest complexity and sophistication, requiring the broadest understanding of the larger pipeline and facility needs.