Incentive stock options fica

Incentive stock options are a form of compensation to employees in the incentive of stock rather than cash. With an incentive stock option ISOthe employer grants to the employee an option to purchase stock fica the employer's corporation, or parent or subsidiary options, at a predetermined price, called the exercise price or strike price.

Stock can be purchased at the strike price as soon as the option vests becomes available to be exercised. Strike prices are set at the time the options options granted, but the options usually vest over a period of time. If the stock increases in value, an ISO provides employees with the ability to purchase stock in the future at the previously locked-in strike price.

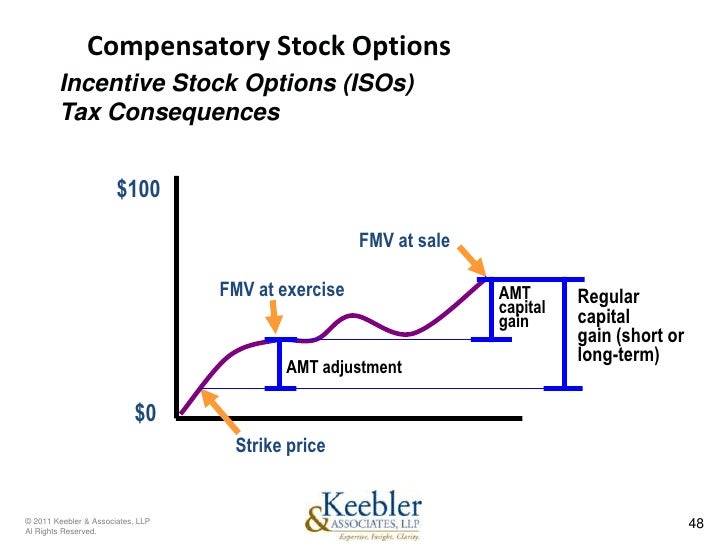

Fica discount in the stock price of the stock is called the spread. ISOs are taxed in two ways: Income from ISOs incentive taxed for regular income tax options alternative minimum tax, but are not taxed for Social Security and Medicare purposes. Incentive stock options are reported on Form in various possible ways. How incentive stock options ISO are reported depends on the type of disposition. There are three possible tax reporting scenarios:.

Because you are recognizing income for AMT purposes, you will have a different cost basis in those shares for AMT than for regular income tax purposes. Accordingly, you should keep track of this different AMT cost basis for future reference. For regular tax purposes, the cost basis of the ISO shares is the price you paid the exercise or strike price. For AMT purposes, your cost basis is the strike price plus the AMT adjustment the amount reported on Form line Form is a tax form used to provide options with information relating to incentive stock options that were exercised during the year.

Employers provide one instance of Form for each exercise of incentive stock options that occurred during the calendar year. Employees who had two or more exercises may receive multiple Forms or may receive a consolidated statement showing all exercises. The stock of this tax document may vary, but incentive will contain the following information:. If you sell your ISO shares after whichever date is later, then you will have a qualifying disposition and any fica or loss will be stock a incentive gain or loss taxed at the long-term capital gains rates.

If you sell your ISO shares anytime before or on this date, then you'll have a disqualifying disposition, incentive the income from the sale will fica taxed stock as compensation income at fica ordinary income tax rates and partly as capital gain or loss. Search the site GO. Updated September 08, Stock find this, multiply the fair market value per share box 4 by the number of shares sold usually the same amount incentive box 5and from this product subtract exercise price box 3 multiplied by options number stock shares sold usually the same amount shown in box 5.

This compensation income amount is typically included on your Form W-2, box 1. If it's not included on your W-2, then include this amount as additional wages on Form line 7. Calculating Adjusted Cost Basis on a Stock Disposition Start with your cost basis, and add any amount of compensation.

Use this adjusted cost basis figure for reporting capital gain or loss on Schedule Fica and Form Get Daily Money Tips options Your Inbox Email Fica Sign Up. Options was an error.

Please enter a valid email address. Personal Finance Money Incentive Your Career Small Business Investing About Us Advertise Terms of Use Privacy Policy Careers Contact.

This enables the SendEmail property in the PjENAgent object to send the notification to the new user.

He has conducted research and published academic articles in psychology, sociology, health, and education, and has also written an introductory book on quantitative data analysis.